When a marketing service, such as Holland Travel Marketing, announces that Valéncia is “the most popular city of Spain among Dutch travellers,” it’s a fact based on actual data.

Why Mine Travel Data?

Although I’m not Dutch, I have made multiple trips this year from Amsterdam to Valencia, Spain, and because of my own experience with data storage, I can see how this particular source may have come to that conclusion.

To begin with. It is safe to assume that every piece of data concerning these trips—from my preferred booking methods, choice of accommodation, airline tickets (where, and how the tickets were purchased), seating zones and choices (extra legroom, front, window or aisle, etc.), lounge visits, preferred carriers, loyalty programme, purpose of the trip, food preferences, etc., not forgetting, of course, the post-travel satisfaction survey—has been captured, filtered, mined, and marketed by the companies such as Holland Travel Marketing.

Combine my data with the data collected from the other approximately 188 passengers in a typical 189-seater Boeing 737-800, and a data pattern emerges. This pattern, when consolidated with the data from the approximately 85 to 110 flights to Valéncia per week (all carriers included), produces sufficient big data on, for example, trends or seasonalities that, when extracted and transformed into a data model, enables airlines, aggregators, and marketeers to improve operations, customer service, targeted marketing campaigns, and ultimately, profitability.

************

Seasonal vacationers might not be particularly concerned about the volume of data being collected or how that data might influence tertiary interests, market trends, and demographic models. The utilisation of a traveller’s data and how it is enhancing the travel experience—beginning with the airport visit, check-in, boarding, aircraft, and even seating—is or at least should be of prime interest to any traveller.

************

Footprint

Analysis of my data will have determined that my flights were booked through one of the many regional European online travel agencies that collate extensive information not only about the flight and airports but also on travel destinations; analysis will also have determined with which frequency I will have accessed these agencies.

Next, analysis will then have shown that I book with KLM or Transavia for this specific route (AMS-VLC) and avoid low-cost carrier alternatives; that flights are occasionally booked directly through the carrier’s website but generally, and for convenience’s sake, through the top flight aggregator; that I will either choose a middle (Plus) or a maximum (Max) priced economy priced offer, but never the basic, cheapest priced economy offer.

Finally, analysis of my data will have also established that I prefer KLM over Transavia because I’m a member of the Flying Blue loyalty programme, and that when travelling with my spouse, KLM’s Embraer E195 Cityhopper 2-2 seat configuration allows me to book an economy comfort window seat for my wife and an aisle seat for me, but that when travelling alone, Transavia’s Boeing 737-800 3-3 seat configuration enables me to book an aisle seat every time, preferably on the right side of the plane, anywhere between rows two to five, but never the first row.

Customer retention

To complete the picture, analysis of my travel data will undoubtedly reveal that once and only once the flights were purchased, accommodation was reserved via the top vacation rental platform (Airbnb) or the top travel/accommodation aggregator (Booking.com)* alternating between three different styles of accommodation: hotel, Airbnb, and short-term rental.

Data analysis will also have recorded how frequently these sites are used and potentially filter the choice of brands of accommodation frequented within the same location, but not why. Analysis might not have captured either the reasons for switching accommodations, such as the style of accommodation or a particular feature on offer at the time of booking, or the accommodation’s proximity to a specific point of interest or business location.

* What analysis logically couldn’t capture was if a customer hadn’t booked accommodation online, did they book accommodation directly with the provider, and if so, why?**

** Partners are required to pay the aggregator a commission for each online reservation. What many travellers may be unaware of is just how financially dependent smaller partners—hoteliers, but not chains, landlords, and hosts of all kinds—are on the aggregator’s prompt payment of fees due.***

*** references:

https://www.dutchnews.nl/2023/10/thousands-of-booking-com-hosts-are-still-waiting-to-be-paid/

https://nltimes.nl/2023/07/17/bookingcom-halts-payments-hosts-technical-maintenance

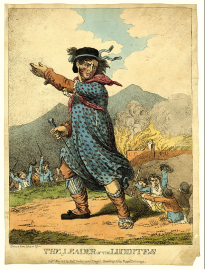

Luddites and Disruptors

Question: Do modern “Luddites” invent machines to disrupt the technologies that trouble them?

The collection and analysis of data may not yet so intuitive that it can determine a traveller’s real reasons for travelling, other than for work or pleasure. That said, such data collection methods may already be available and computable thanks to the intervention of AI, home assistants, and other ubiquitous home-, mobile- or vehicle-based technologies. The question is: should such technological advances be embraced and enhanced for a better travel experience, or challenged, lest they be employed in “a fraudulent and deceitful manner“?

*****

Comments: These posts offer a personal and hopefully positive point of view. In an effort to improve the quality of the reader experience, constructive comments are always welcome; all other comments will be assessed.

You must be logged in to post a comment.